Let’s be honest – dealing with banks and trying to understand all the fees, products, and covers they offer can sometimes feel like trying to learn a new language. But having the right insurance protection from your bank is crucial, especially when it comes to safeguarding your hard-earned money and assets.

As a Nigerian bank customer, you may have heard terms like “deposit insurance”, “credit life insurance” and “asset insurance” getting thrown around. But what do they actually mean and cover? Let’s break it down in simple terms.

Deposit Insurance

This one is pretty straightforward. Deposit insurance protects your money sitting in savings accounts, current accounts, or fixed deposits at your bank in case the bank runs into financial difficulties or has to be shut down.

In Nigeria, all deposit money banks are required to insure deposits up to a maximum of ₦500,000 per depositor through the Nigeria Deposit Insurance Corporation (NDIC). The NDIC would refund you up to ₦500,000 of the money you had in deposit accounts there.

The NDIC covers you whether you have just a simple savings account or you’ve stashed money across different account types at the same bank. Just keep in mind that the ₦500,000 limit applies to your total deposits per bank, not per account.

Credit Life Insurance

Okay, say you’ve taken out a loan from your bank like a mortgage to buy your dream home anywhere in Nigeria or a car loan to upgrade your ride. Credit life insurance means that if something unfortunate happens to you like permanent disability or death before you’ve finished paying off that loan, the insurance will settle the remaining debt.

Most Nigerian banks actually require you to take out credit life insurance anytime you borrow from them. The premium is usually just a small percentage loaded onto your loan repayments. It gives you the peace of mind of knowing your family won’t be saddled with that debt if you’re no longer around.

Asset Insurance

Moving on to asset insurance which protects your valuable possessions that you may have taken a loan out for or used as collateral at the bank. We’re talking about things like your house, vehicles, equipment for your business, and so on.

If any of those assets get damaged or stolen, having them comprehensively insured means the bank can make a claim and recover the outstanding amount you still owe on the asset. That way you’re not stuck still paying for something you can no longer use or no longer have.

Most Nigerian banks will mandate you to take out asset insurance from approved insurers before disbursing loans for high-value items. The annual premium is typically between 0.5% – 3% of the asset’s value depending on what’s being covered.

There you have it – the key insurance products offered by Nigerian banks to keep your money, debts, and valuables protected. At the end of the day, having this cover gives you invaluable peace of mind so you can focus on building your wealth without worrying about the what-ifs.

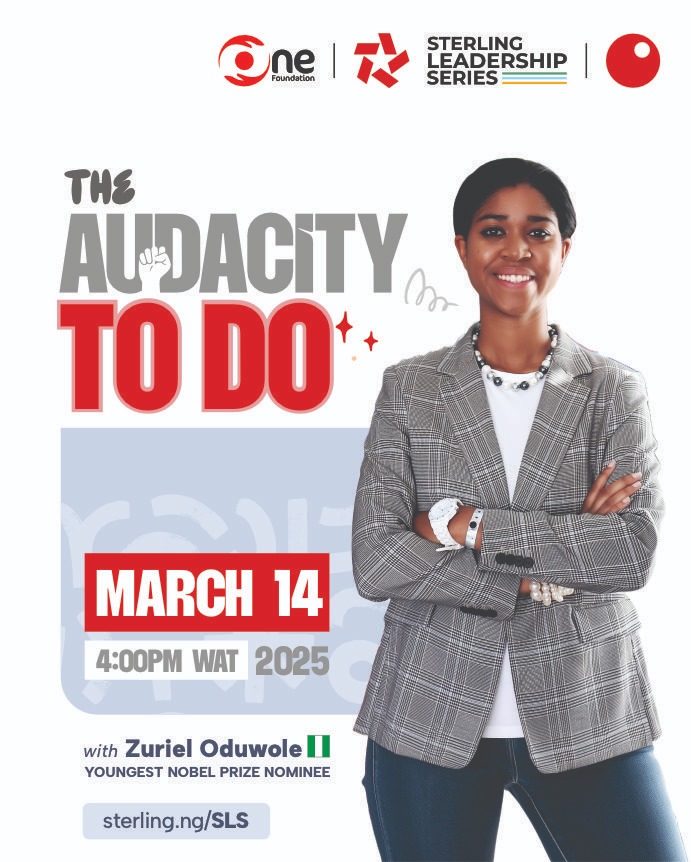

At Sterling, supporting your wealth is hugely important to us.

Click here to learn more about our commitment.