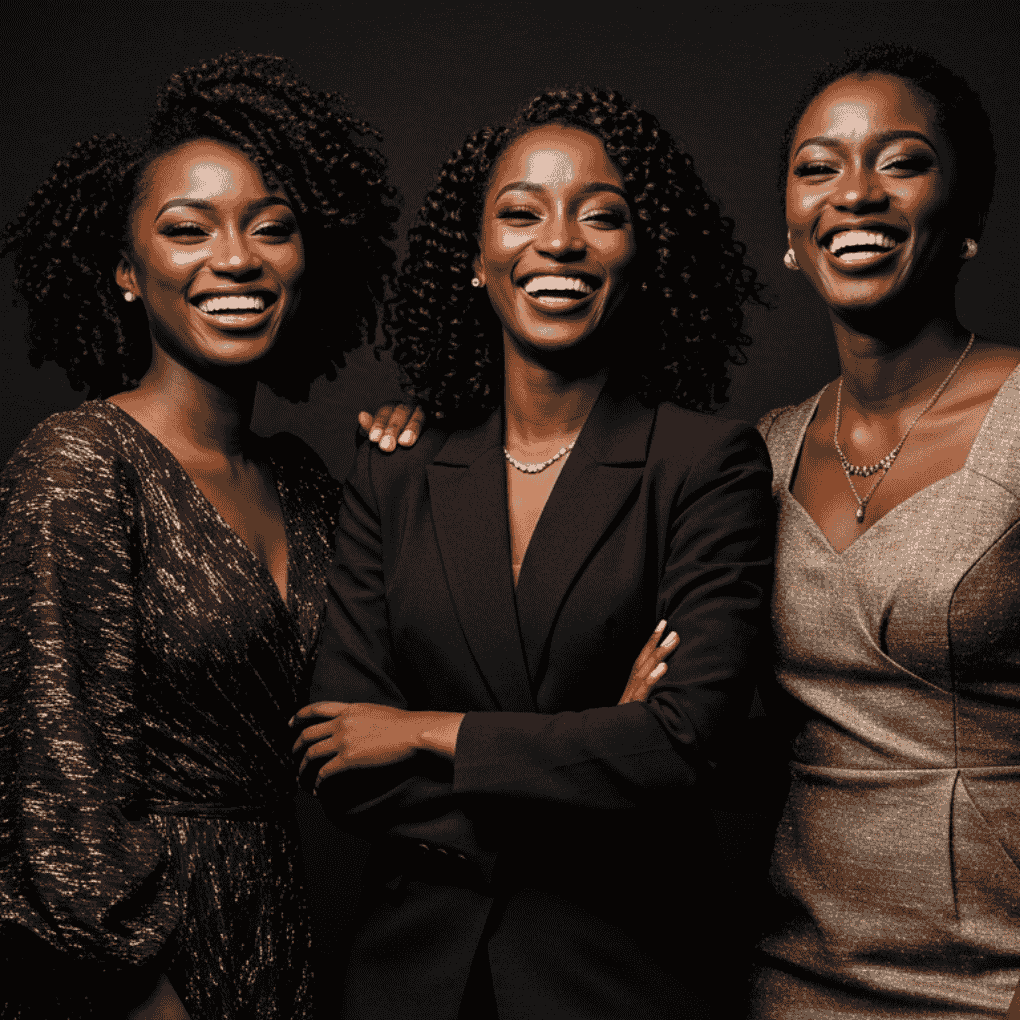

Finances. Freedom. Future.

For women worldwide, financial independence isn’t just about figures, it’s about fundamentally forging paths forward.

As we enter March, commemorating Women’s History Month, it’s worth reflecting on the financial insights shared by women who’ve broken barriers in economics, business, and personal finance. Their wisdom offers valuable lessons for anyone seeking financial stability.

“A budget is telling your money where to go instead of wondering where it went,” said financial expert Suze Orman, capturing the essence of financial control. This simple truth reminds us that intentionality matters more than income size.

Ngozi Okonjo-Iweala, first female Director-General of the World Trade Organization, emphasized: “If you don’t have good financial management, it doesn’t matter how much money you have, you will still go broke.” Her pragmatic approach highlights that financial discipline outweighs raw earning power—a crucial lesson for wealth preservation.

Mellody Hobson advised: “The biggest risk of all is not taking one.” Financial growth often requires calculated risks. Whether investing in the stock market, starting a business, or pursuing education, comfort with measured risk-taking separates those who merely survive financially from those who thrive.

“Don’t just save for the rainy days, invest for the sunny ones too,” shares Folorunsho Alakija, one of Nigeria’s most successful businesswomen. Her wisdom reminds us that while emergency funds are essential, strategic investment creates true wealth and opportunity.

“Do not save what is left after spending, but spend what is left after saving,” counseled investor Ruth Porat. This principle flips conventional thinking—prioritize saving before allocating funds elsewhere.

“Never depend on a single income,” warned entrepreneur Swati Bhargava. “Make an investment to create a second source.” In today’s economy, multiple income streams provide security. Financial well-being isn’t just about accumulation, it’s about alignment with values.

As economist Alice Rivlin noted, “The point is not to make money, the point is to make meaning.”

As we celebrate women’s contributions this March, remember that financial wisdom isn’t gender-specific, it’s universal. The insights from these pioneering women can guide anyone seeking to build wealth, security, and purpose with Sterling as your trusted partner along the journey.

What financial lesson from a woman has most influenced your relationship with money? Comment below and don’t forget to Chat with Naya today about your finances