POV: They are playing BNXN’s finesse in the club. You and your guys just chattered bottles and you are screaming at the top of your lungs. “Ah, finesse, if I broke na my business…”. You’re having the fun and carefree night you think you deserve seeing as tomorrow is Monday. But just as you’re about to spend your last 5k on suya, you remember you haven’t bought fuel in your car, you don’t have money for tomorrow’s lunch and your daughter may or may not have mentioned something about pending PTA fees…

Are you even an adult if you don’t make money mistakes once in a while? A 2019 study by Finder.com found that an estimated 126.5 million American adults have made a money mistake at least once in their lifetime. The biggest issue, however, is that many people don’t even know they are making mistakes before it is too late.

So in this article, we’re going to tell you our controversial opinions on some of the financial mistakes Nigerian youths need to stop making;

1. Marrying Solely For Love

You heard we were breaking tables but you chose to stand on this one? Jokes! We as a society need to let go of this ‘love conquers all’ narrative especially when it comes to marriage. Marriage has so many benefits and financial upliftment is also one of them. Are you choosing a partner that is financially educated, and knows how to save, budget, and invest?

2. Waiting till you’re rich before you start investing

The higher you earn, the more taxes you pay. Wealthy people understand this, which is why a majority of their income comes from assets like stocks, real estate and businesses. And I am sure you know that waiting to become rich wasn’t what got them there. Use your ‘small’ salary to buy assets and watch these assets buy your financial freedom in due time. You can start investing today on i-invest with as little as N1k.

3. Living beyond your means

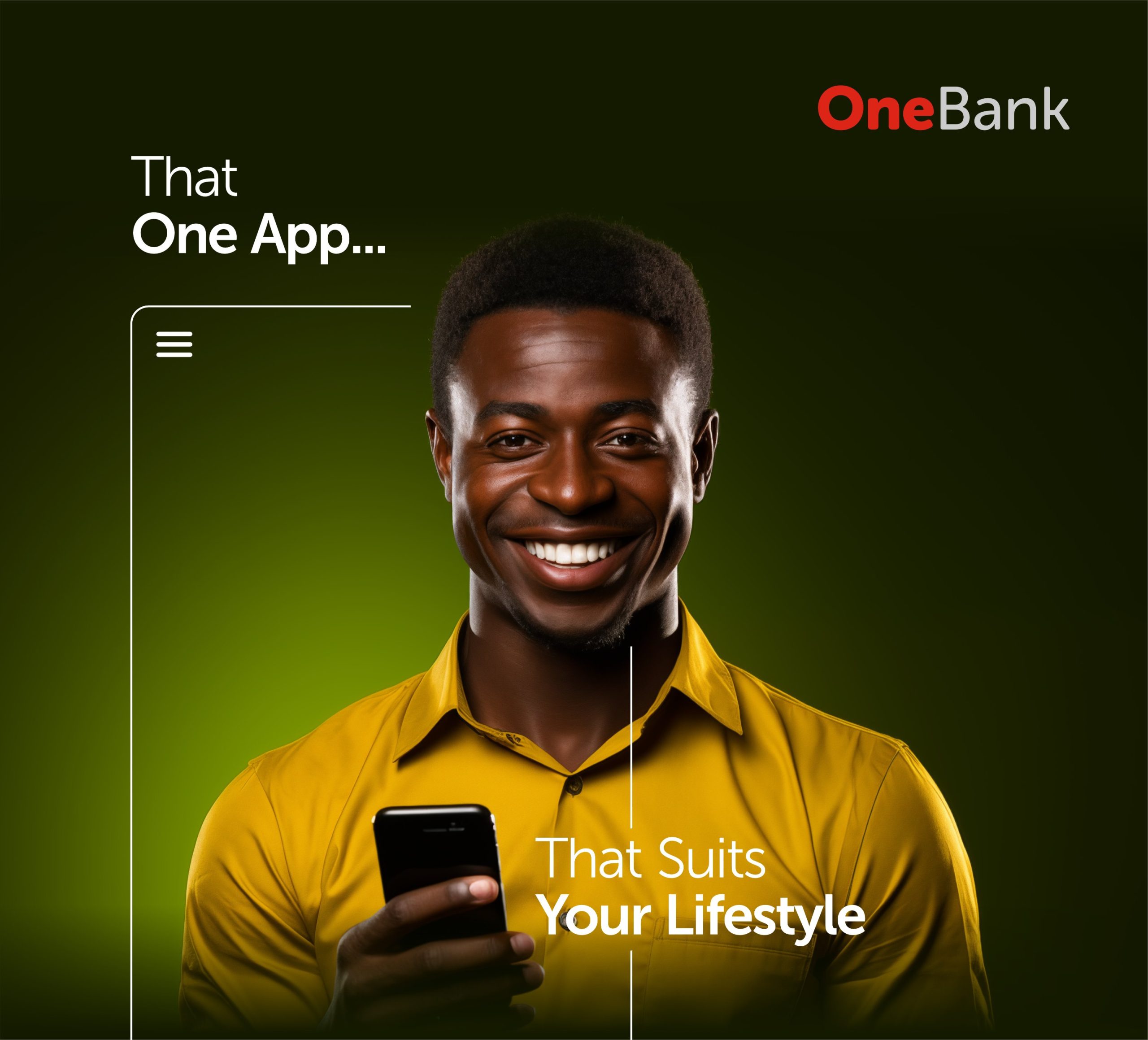

Ever heard of lifestyle inflation? Lifestyle inflation is when an increase in an individual’s income ultimately leads to an increase in spending. Lifestyle inflation is what causes people to get stuck in a cycle of living payday to payday where they have just enough money to pay their bills every month. To avoid this, make sure you track your expenses on OneBank.

4. Borrowing friends money you can’t afford to let go of

My grandmother once told me that borrow-borrow is the worst enemy of friendship. It’s always a good thing to come through for your friends especially in their time of need. But borrowing more money than you can let go of will always be a financial mistake because what if your friend cannot pay it back?

5. Relying on one stream of income

Having a well-paying job is one thing but having many well-paying sources of income is another. That is what we call true wealth and resources. It’s never too late to start that side business. You can always contact the business hub to get your business fired up and running in no time.

Which of these financial mistakes have you made or will you advise against making? Let us know in the comment section