Imagine a world without electricity? Without it, our lives would be radically different, and in almost every instance a whole lot harder. Regrettably, access to electricity for Nigeria’s over 100 million rural inhabitants is estimated at 36% while it is almost 60% for urban dwellers.

It is not surprising that the World Bank has ranked Nigeria as the second largest country in the world after India and the first in Sub-Saharan Africa with the highest number of people deprived of electricity. Ironically, electricity generation started in Nigeria in 1896 with her first electric utility company established in 1929.

As it stands, between 500,000 to 800,000 new households would have to be connected to electricity sources every year between now and 2030 for the country to achieve her target of universal access to electricity for all its citizens.

Certainly, life without electricity is tortuous and has been aptly described as living in the dark. It deprives excluded people or communities every basic comfort and fuels migration. For instance, residents of Unguwar Dogo, a village in northern Katsina, travel 40 minutes to another village to charge their mobile phones. This community is limited to the use of traditional sources of energy such as firewood, animal dung, and crop residues for heating and cooking which are effective causes of harmful indoor air pollution.

In contrast, access to electricity improves the quality of life and accelerates development of rural communities by enabling access to safe potable water, improved sanitary and health conditions, food security, as well as lighting and information. Access to electricity is not only critical for improving living standards but regarded as indispensable for eradicating poverty.

To bridge the country’s gaping electricity deficit estimated at more than 20 million homes, Sterling Bank Plc has identified renewable energy as an alternative form of energy which can be easily and conveniently delivered to millions of Nigerian homes, small, medium and large enterprises in both urban and rural areas.

Affirming this, Abubakar Suleiman, Chief Executive Officer, Sterling Bank, disclosed that the bank has committed itself to be at the heart of Nigeria’s accelerated development by focusing on five critical sectors of the economy namely Health, Education, Agriculture, Renewable Energy and Transport. Taking the first letters of these sectors, one is pleasantly surprised to see them form the word HEART. Abubakar calls these five critical sectors, the HEART of Sterling.

Abubakar Suleiman, Chief Executive Officer, Sterling Bank

According to the Bank Chief, Nigeria’s power problem affects businesses and communities, and must be solved to ensure quality life for all citizens as well as accelerated economic development. He believes that resolution of the power problem through decentralized renewable energy solutions will lead to rapid industrialization, job creation, quality education and healthcare delivery, among many other benefits.

The Bank’s three-pronged approach to achieving this are financing, trading and partnerships. It has set aside funds for large projects that provide electricity to communities and businesses. From the trading perspective, it is creating a platform that enables the sale of renewable energy solutions between electricity generators, distributors and users. Finally, Sterling Bank is creating partnerships to encourage the flow of foreign investments into the renewable energy space in order to bridge the service gaps which currently exist in market.

Remarkably, the Bank has signed an agreement with the Kaduna State Government, Kaduna Business School and Blue Camel Energy to deliver a renewable energy solution called ‘Solar-fi hub.’ The hub was developed by a start-up incubated by the Kaduna Business School.

Dr. Dahiru Sani, Rector, Kaduna Business School, said the mini accelerator project was created to improve access to electricity with the invention of Solar-fi hub as outcome. “The Solar-fi hub is powered by solar energy to meet the day-to-day needs of the average citizen who may want to listen to news, watch football matches, or boil water for domestic use”, Sani disclosed.

According to the Rector, the Solar-fi hub can be used by farmers in rural communities to power grinding machines and water pumps for irrigation while also bridging small power needs like charging of phones in homes where there is no power. He added the partnership between the Kaduna Business School, Blue Camel Energy and Sterling Bank to deliver the Solar-fi hub will improve the quality of life and earning potential of rural dwellers.

Commending Sterling Bank for believing in the renewable energy dream, Yusuf Suleiman, Managing Director, Blue Camel Energy, said solar energy is the future of electricity in developing countries. He added that Blue Camel Energy is laying the foundation for the democratisation of electricity to homes, businesses and schools ensuring that they can generate their own cost-effective electricity using solar energy.

Yusuf disclosed that Blue Camel Energy initiated and completed its assembly plant and academy within eight months. The plant has the capacity to assemble over 10,000 units of clean, affordable and reliable solar products in a year while the academy has the capacity to provide energy entrepreneurship training to about 3,000 youths within the same period.

“We are ready to lead in solving energy-related problems across different sectors of the economy. So far, we have invested over $1 million and would be investing another $5 million in the next 24 months to ensure delivery of solar-generated power to factories”, Suleiman informs.

Similarly, Sterling Bank partnered with Zola Electric, a for profit social enterprise, to make distributed renewable energy accessible to Nigerians businesses and households in need of constant and clean power supply. Adaptable to energy need and income, Zola’s renewable energy solutions can be easily accessed through consumer finance from Sterling Bank.

Chief Executive Officer, Zola Electric, Mr. Bill Lenihan said the company has studied the Nigerian electricity market and figured out a way to proffer lasting solution to the country’s electricity needs. “Our solutions are designed to solve every level of the energy access problem. And while financing has been identified as one of the key limitations for consumers to acquire renewable power solutions, our partnership with Sterling Bank ensures access to product finance for interested customers.”

Despite the commitment of Nigerian Electricity Regulatory Commission (NERC) to stimulating investment in renewable energy, little progress has been made in the sector. Existing investments in power grids built on fossil fuels keep players tied to costly and pollution inducing energy sources regardless of the obvious advantages of renewable energy solutions.

However, all of this might become a thing of the past considering Sterling Bank’s commitment to bridging the funding gap hitherto faced by would-be adopters of renewable energy solutions. This indicates that Nigeria will eventually tap the potential of its abundant renewable energy resources for socio-economic benefits.

International development agency, Oxfam, believes renewable energy solutions are more reliable, effective and affordable for poor people in developing countries who do not have access to electricity. This is especially true for northern Nigeria where the electricity grid does not extend to remote areas and the distances between villages are significant. Apart from being generally clean and pollution-free, renewable energy sources are sustainable natural forms of energy which require less maintenance than traditional generators.

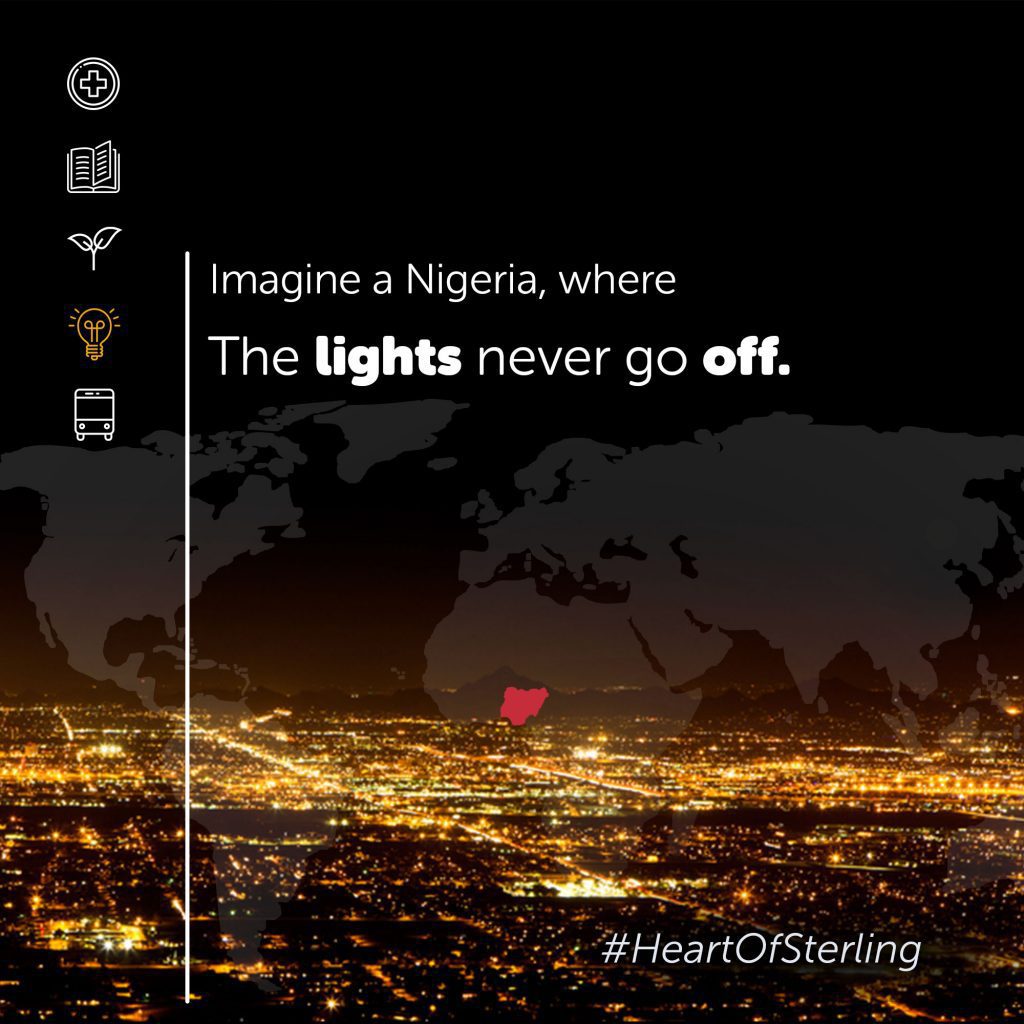

Imagine a Nigeria where the lights never go off.

Truly so, renewable energy facilities are more suitable for community management and ownership because they can be set up in small units. By investing heavily in renewable energy solutions, Sterling Bank is lighting Nigeria’s path to development. It is apparent that the bank has its HEART in the right place.