Inflation is a harsh reality for businesses around the world, and Nigeria is no exception. From rising costs of raw materials and rent to employee wages, businesses big and small are feeling the pinch. While we can’t control the economic tides, we can equip ourselves with the right tools to weather the storm.

This article explores the impact of inflation on Nigerian businesses and provides actionable strategies to navigate this challenging economic climate. But before we dive in, there’s good news! Join us for our upcoming MSME Huddle on May 7th at 2 PM to learn How to Raise N50m Without Collateral to Grow Your Business. Click HERE to register and secure your spot.

The Impact on Businesses

The Impact on Businesses

In Nigeria, small businesses face a multi-pronged attack from inflation. Rising costs for everything from raw materials and rent to employee wages eat directly into profits, making it harder to stay afloat. This squeeze is further amplified by weakened consumer spending power. As people have less money to spend, non-essential purchases often take a back seat, potentially leading to declining sales. While businesses reliant on imports might feel the pinch more acutely due to global price increases, even locally-focused businesses are not immune. The cost of locally produced goods can also be affected by rising transportation and production costs, creating an uneven but still impactful situation.

But there is hope! Even in this challenging environment, there are strategies businesses can adopt to not only survive but thrive.

Strategies for Success

Now, let’s move on to the good stuff – actionable strategies to help your business navigate this economic climate. Here are a few key areas to consider:

Now, let’s move on to the good stuff – actionable strategies to help your business navigate this economic climate. Here are a few key areas to consider:

- Trim the Fat: Scrutinize your expenses and identify areas for reduction. Can you negotiate better deals with suppliers? Streamline your operations to become more efficient? With the Sterling Business Zero AMF Account, you can focus on running your business without worrying about bank charges eating into your expenses. This can be a significant advantage, especially for startups and businesses looking to optimize their costs. Remember, every naira saved goes straight to your bottom line.

- Pricing Strategy: This is a delicate dance. While you may need to adjust pricing to reflect your own rising costs, be mindful of maintaining competitiveness and not alienating your customer base. Consider offering smaller portion sizes or introducing budget-friendly product lines to cater to changing consumer needs. In acknowledgment of these economic hardships, many businesses are implementing buy now, pay later (BNPL) options. This strategy allows customers to spread the cost of their purchases over installments, making them more accessible during inflationary times. However, it’s crucial to carefully evaluate the fees and terms associated with BNPL options to ensure they are sustainable for your business.

- Embrace Innovation: Sometimes, the best defense is a good offense. Use this time to explore new revenue streams, diversify your product offerings, or tap into innovative marketing strategies to reach new customer segments. Remember, challenging times often breed creativity and lead to unexpected opportunities. Many Nigerian businesses are launching same-day delivery services in major cities to cater to busy customers willing to pay a premium for convenience. This is an example of the kind of innovation your business might need.

- Invest in Your People: Your employees are your most valuable asset. During inflationary periods, it’s crucial to maintain open communication, acknowledge the challenges, and invest in their well-being. Consider offering competitive compensation packages or exploring alternative benefits to keep your team motivated and engaged.

In recognition of economic difficulties, many companies are implementing flexible work arrangements like work-from-home or hybrid work options. This can significantly reduce employee expenses on transportation and childcare, while also offering a better work-life balance, which can boost morale and productivity.

In recognition of economic difficulties, many companies are implementing flexible work arrangements like work-from-home or hybrid work options. This can significantly reduce employee expenses on transportation and childcare, while also offering a better work-life balance, which can boost morale and productivity.

While navigating inflation presents undeniable challenges, it also opens doors to exciting possibilities. By elevating the narrative around your local solutions, showcasing their unique features and the value they offer, you can not only sustain your business but also contribute to a stronger local economy. Here’s how:

- Collaboration is Key: Joining forces with other local businesses allows you to share resources, expertise, and marketing efforts, expanding your reach while reducing costs. This collective approach strengthens the local economy, creating a ripple effect that benefits everyone.

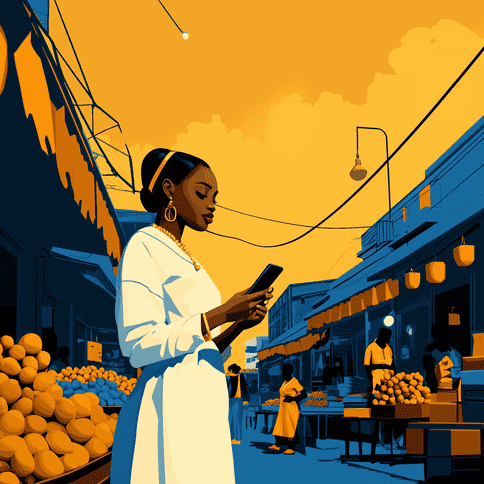

- Technology as a Powerful Tool: Embrace online platforms like MBN to connect with customers, utilize mobile payments for added convenience, and leverage social media to spread the word about your solutions. These strategies allow you to connect with a wider audience and showcase the value you offer.

- Value over Price: While cost remains a concern, remember that your solutions deserve fair value. Instead of solely focusing on price, consider offering tiered pricing to cater to different budgets. Highlight the unique benefits your local solutions provide – convenience, personalization, or a superior customer experience – to justify their value. Additionally, explore alternative revenue streams like repairs, workshops, or consultations to further strengthen your financial standing.

This is where your voice matters. What are your thoughts on the potential for local solutions amidst inflation? Have you identified any opportunities for your business within the domestic market? We would love to hear from you!

Did you find this article helpful? Comment, like, and share!